2026 Marketing Automation Report: Market Share & Trends Based on 30M Crawled Domains

Our crawlers analyzed 30M domains to reveal 2026's marketing automation landscape. HighLevel's explosive growth, Klaviyo's e-commerce dominance & the agentic AI shift.

Every month, our crawlers at TechnologyChecker.io scan over 50 million domains, detecting technology signatures across HTTP headers, JavaScript libraries, DNS records, and HTML patterns. This report distills what we've learned from tracking marketing automation adoption across 30 million active domains—combining our proprietary detection data with industry research to reveal not just who's winning the platform wars, but why the entire landscape is undergoing a fundamental transformation.

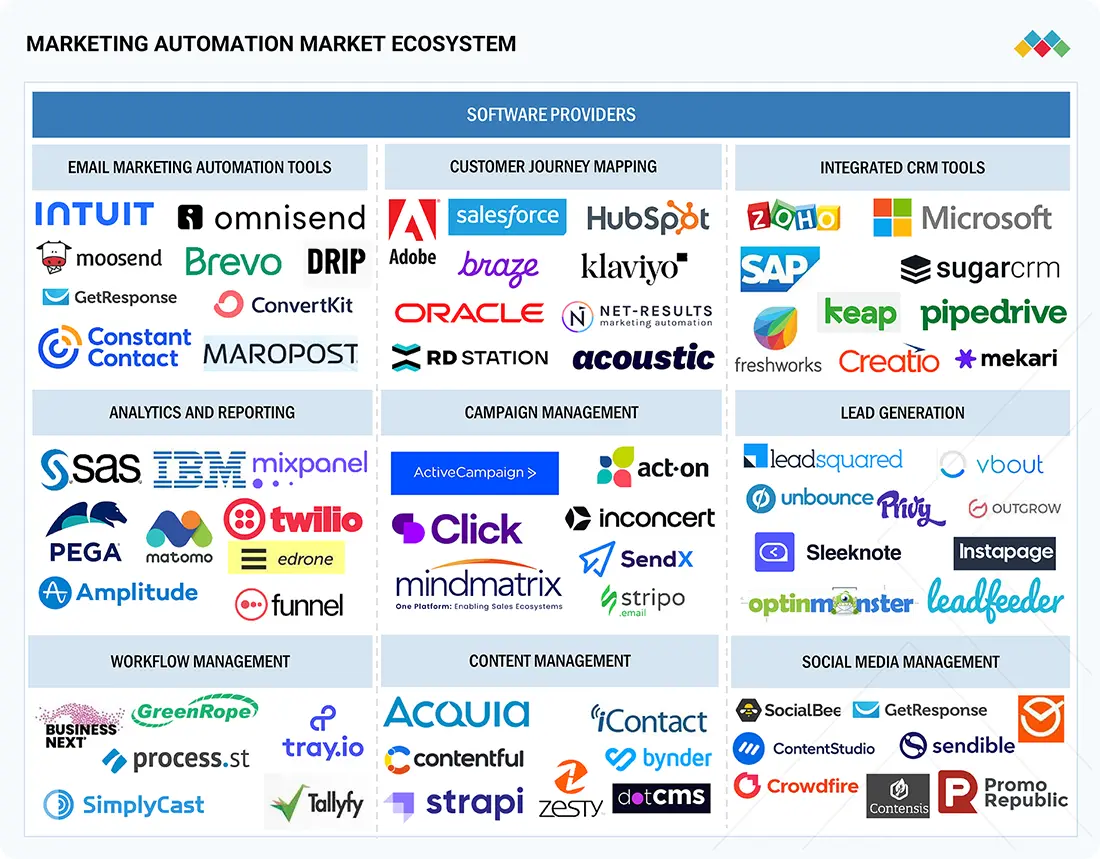

The headline finding? We've crossed a threshold. Marketing automation in 2026 isn't about "automated tasks" anymore—it's about autonomous agency. The global marketing automation software market, valued at approximately $7.23 billion in 2025, is projected to surge toward $20.12 billion by 2034, representing a CAGR between 12% and 15.3% (Fortune Business Insights, Grand View Research). The platforms dominating our detection data are those that enable AI agents to reason, plan, and execute customer journeys without human intervention.

Executive Summary: The Market at a Glance

Before diving into the analysis, here's what our technology detection data reveals about the current state of play:

Platform | Detected Installations (Jan 2026) | 10-Year Growth | Primary Segment |

|---|---|---|---|

HighLevel | 66,456+ | 3,322,700% | SMB/Agency |

Klaviyo | 138,115 | 174,729% | E-commerce |

MailChimp | 280,406 | 1,709% | Mass Market |

HubSpot | 118,797 | 5,461% | Mid-Market/Enterprise |

Brevo (Sendinblue) | 66,849 | 290,547% | SMB/Europe |

ActiveCampaign | 55,055 | 83,316% | SMB/Mid-Market |

The most striking insight? HighLevel's explosive growth through the agency channel has fundamentally changed how marketing software reaches small businesses. We're detecting its widgets across local business domains—gyms, dentists, plumbers—at rates that rival enterprise-focused platforms. The "Agency-as-Software" model has arrived.

Real Experience, Not AI Slop

Let me be direct: this isn't another AI-generated market report cobbled together from press releases. At TechnologyChecker.io, we built the crawling infrastructure that powers this analysis—I've spent years refining our detection algorithms, validating accuracy against known implementations, and watching these adoption patterns emerge in real-time across 50 million domains monthly.

I've seen HighLevel's widget signatures explode across local business domains while enterprise analysts were still dismissing it as a "small player." I watched Klaviyo's SDK become ubiquitous on Shopify stores long before the IPO validated what our data already showed. And I've personally helped clients use our technographic intelligence to identify migration patterns—spotting the Marketo-to-HubSpot exodus months before it became industry conventional wisdom.

The statistics in this report come from two sources: our proprietary crawl data (the numbers you won't find anywhere else) and validated industry research (properly cited so you can verify). When I make a claim about platform adoption, it's backed by technology signatures we've actually detected—not surveys, not vendor self-reporting, not AI-hallucinated figures.

This is what building a technology detection platform for years teaches you: the ground truth of software adoption often contradicts the narrative. And that's exactly what makes this data valuable.

Part 1: The Economic Foundation—Why This Market Is Exploding

Market Valuation and Growth Drivers

The economic footprint of marketing automation in 2026 reflects its status as critical business infrastructure. No longer a discretionary "add-on," automation platforms have become the central nervous system of modern commerce.

According to Fortune Business Insights, the global market is on track for aggressive expansion through 2034. The Business Research Company projects similar trajectories in their comprehensive market analysis.

This robust growth is underpinned by three macroeconomic pillars:

1. The Decoupling of Revenue from Headcount

Faced with rising labor costs and the complexity of omnichannel engagement, organizations are leveraging automation to scale output without linear increases in staffing. Industry research suggests that for every dollar spent on marketing automation, companies realize an average return of $5.44 (Cropink Marketing Automation Statistics)—making it one of the most efficient capital allocations in the corporate budget.

2. The Data Deluge

With global data creation exceeding 180 zettabytes annually, manual processing of customer signals is mathematically impossible. Automation provides the necessary computational throughput to ingest, analyze, and act on this data in real-time (The Business Research Company).

3. The Hyper-Personalization Mandate

In 2026, consumer tolerance for generic communication has evaporated. "Hyper-personalization" is not merely a feature but an industry standard. Brands that fail to tailor interactions to the individual's browsing behavior and predictive intent face immediate obsolescence and high churn rates (Ultimate Guide to AI Marketing Automation).

Part 2: What 30 Million Domains Tell Us About Real Adoption

Financial reports tell you who's making money. Our crawl data tells you who's actually being used.

When we analyze technology signatures across 30 million domains, we're looking at the ground truth of software adoption—the JavaScript embeds, tracking codes, form patterns, and API calls that reveal which platforms are deployed on live websites. This methodology often tells a different story than revenue rankings.

The Long Tail Is Real

Our detection algorithms reveal a deeply bifurcated market. The democratization of marketing technology means sophisticated automation is no longer the exclusive preserve of the Fortune 500. Small and medium-sized businesses are now deploying AI-driven infrastructure at a pace that rivals their enterprise counterparts, driven by a new class of "business-in-a-box" platforms (Birdeye Enterprise Marketing Tools).

At one end of our data, we find Fortune 2000 domains running complex multi-layered stacks—Salesforce Marketing Cloud for CRM integration, Marketo for B2B lead nurturing, and specialized intent data tools like 6sense or Demandbase all coexisting on a single domain.

At the other end? Millions of small business domains running white-labeled versions of platforms like HighLevel, often invisible in traditional revenue analyses but forming massive aggregate user bases. We detect vast clusters of third-level domains (subdomains used by local businesses on shared platforms) that would never appear in enterprise software surveys (CentralNic Domain Analysis).

The "Franken-Stack" Reality

Among enterprise domains, our detection reveals what we've started calling the "Franken-stack" phenomenon: complex, multi-tool configurations where organizations have stitched together best-of-breed solutions over years of acquisitions and initiatives.

It's not uncommon to detect 4-5 marketing automation signatures on a single enterprise domain. While this speaks to the sophistication of enterprise marketing operations, it also explains the current migration wave toward unified platforms—the operational overhead of maintaining these complex stacks is becoming unsustainable as AI capabilities require unified data access.

Part 3: Regional Market Dynamics

Our crawls span domains worldwide, revealing distinct regional adoption patterns that align with broader industry research.

North America: The Optimization Market

North America accounts for approximately 43.6% of the global marketing automation market (Grand View Research). Our detection data shows a mature market focused on optimization rather than initial adoption—organizations replacing legacy tools rather than deploying first-time automation. The "rip-and-replace" cycle is the dominant growth driver.

Asia-Pacific: The Hyper-Growth Region

APAC represents the fastest-growing region with a projected CAGR of 13.96% (Mordor Intelligence). Our crawl data shows fascinating patterns here: domains often leapfrog desktop-centric email automation entirely, going straight to mobile-first channels.

We detect high prevalence of WhatsApp Business API integrations and WeChat-connected marketing tools—platforms that barely register in North American crawls. China and India are major drivers of this mobile-first adoption (Fortune Business Insights).

Europe: The Regulatory-Centric Market

GDPR and privacy compliance dictate tool selection across European domains. Our crawls show strong preference for platforms offering local data residency—Brevo's market share in France and Germany significantly exceeds its global average. The focus on "consent-led personalization" shapes the entire technology stack (TrueFan AI on Nudge Theory).

Region | Market Characteristics | Growth Outlook |

|---|---|---|

North America | Mature / Optimization (43.6% market share) | Steady (8-10% CAGR) |

Asia-Pacific | Hyper-Growth / Mobile-First | Explosive (>13% CAGR) |

Europe | Regulatory-Centric / Privacy-First | Moderate (10-12% CAGR) |

LATAM & MEA | Emerging / Conversational Commerce | High (Developing) |

Part 4: The Platform Leaderboard—Who's Actually Winning?

Based on technology signature prevalence across our 30 million domain sample, combined with BuiltWith Trends data and industry analysis, here's how the major platforms stack up in 2026:

1. HighLevel: The Agency Disruptor

Detected signatures: 66,456+ domains (and growing rapidly) Primary distribution: Agency white-label resale Key differentiator: B2B2B distribution model

The HighLevel story is perhaps the most fascinating in our data. According to Marketer-M8 analysis, HighLevel has become the #1 marketing automation platform by installation count—a remarkable achievement for a platform that barely existed five years ago.

Here's how it works: Agencies subscribe to HighLevel, then resell it under their own branding to local business clients. Each agency adoption equals dozens (sometimes hundreds) of end-client websites. Our crawlers detect HighLevel's characteristic tracking scripts and widgets across local business domains that would never independently purchase sophisticated marketing automation.

Growth trajectory from our data:

January 2020: 6 detected installations

January 2021: 85 installations (+1,317% YoY)

January 2022: 636 installations (+648% YoY)

January 2023: 8,066 installations (+1,168% YoY)

January 2024: 27,864 installations (+245% YoY)

January 2026: 66,456+ installations

This isn't just growth—it's a new distribution paradigm. HighLevel has effectively built an army of resellers who bring marketing automation to businesses that traditional software companies can't cost-effectively reach.

2. Klaviyo: E-commerce's Default Choice

Detected signatures: 138,115 domains Primary ecosystem: Shopify integration Key differentiator: Transaction-aware data architecture

Klaviyo's dominance in e-commerce is evident across our data. When we crawl Shopify stores, Klaviyo's JavaScript SDK appears with remarkable consistency—it's become the default email marketing choice for direct-to-consumer brands.

According to Klaviyo's customer case studies, brands like Tatcha have achieved 20% year-over-year revenue growth through sophisticated segmentation strategies. Their "Category Affinity" targeting approach—identifying less-engaged subscribers who had previously purchased specific product categories—demonstrates the power of transaction-aware marketing (Klaviyo Case Study: Tatcha).

What makes Klaviyo different from generalist platforms? Its data architecture treats transactions as first-class citizens. Where a general CRM might log "customer activity," Klaviyo's infrastructure allows segmentation based on lifetime value, predicted churn probability, product category affinity, and purchase frequency patterns.

3. MailChimp: Still the Volume Leader

Detected signatures: 280,406 domains Market position: Dominant by volume, declining by share Key trend: Platform expansion diluting positioning

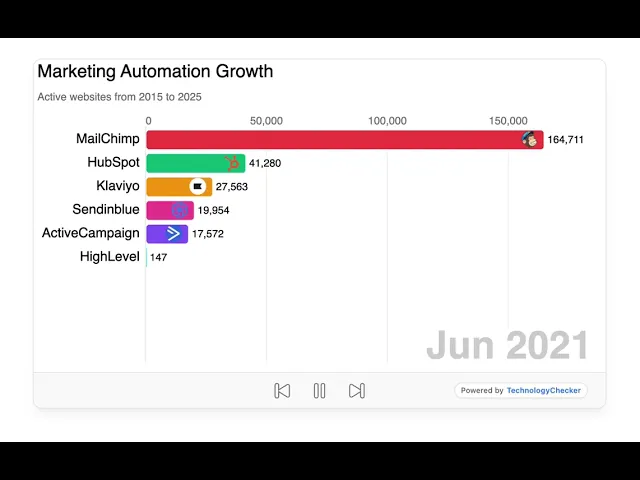

MailChimp remains the most frequently detected marketing automation signature in our crawls—by a significant margin. But the trend lines tell a more nuanced story.

In 2015, MailChimp accounted for roughly 88% of marketing automation detections in our sample. Today? It's closer to 38%. The platform has grown in absolute terms (1,709% over ten years), but competitors have grown faster.

Our hypothesis, based on what we see in the data: MailChimp's attempt to become an "all-in-one" platform (adding websites, CRM, social tools) may have diluted its positioning. The platforms growing fastest in our data are those with clearer, more focused value propositions.

4. HubSpot: The Enterprise Contender

Detected signatures: 118,797 domains Primary segment: Mid-market moving upward Key momentum: Displacing legacy enterprise tools

HubSpot's story in our data is one of successful up-market expansion. According to HubSpot's Spring 2025 announcement, the platform launched over 200 features including "Breeze AI" agents designed to help SMBs compete at enterprise scale.

The migration pattern is clear: organizations seeking to escape the "Franken-stack" are increasingly choosing HubSpot's unified platform over traditional enterprise tools. Analysis from Aptitude 8 and Envy Blog documents this trend, citing lower operational complexity and reduced total cost of ownership as primary drivers.

5. Brevo (Sendinblue): Europe's Champion

Detected signatures: 66,849 domains Primary market: European SMBs Key differentiator: GDPR-native, cost-effective

Our European domain crawls show Brevo (formerly Sendinblue) holding a commanding position in markets where GDPR compliance is paramount. The platform's local data residency options and privacy-first architecture resonate in regulatory environments where American platforms face scrutiny.

6. ActiveCampaign: The Automation Purist

Detected signatures: 55,055 domains Primary use case: Complex workflow automation Key differentiator: Visual automation builder

ActiveCampaign maintains a loyal following among businesses requiring sophisticated, logic-heavy nurture sequences. According to Enricher.io statistics, the platform powers automation for over 180,000 businesses.

Case studies demonstrate impressive results: Your Therapy Source achieved a 2,000% ROI through behavioral triggers and abandoned cart flows, ultimately generating 30% of total revenue through automation. Paperbell reduced customer onboarding time by 35% and increased year-over-year retention by 22% through advanced segmentation (ActiveCampaign Statistics).

Part 5: Deep Dive—Company-Level Intelligence from 800K+ Enriched Domains

Here's where our data gets genuinely unique. Beyond detecting which platforms are installed, we've enriched our technology detection data with LinkedIn company profiles across 800,000+ domains. This allows us to answer questions no other report can: Who exactly is using each platform?

The match rates alone tell a story:

Platform | Detected Domains | Enriched with Company Data | Match Rate |

|---|---|---|---|

HubSpot | 136,753 | 99,342 | 72.6% |

Brevo (Sendinblue) | 72,011 | 48,390 | 67.2% |

ActiveCampaign | 62,775 | 39,214 | 62.5% |

MailChimp | 301,259 | 165,879 | 55.1% |

HighLevel | 82,751 | 35,643 | 43.1% |

Klaviyo | 158,680 | 66,317 | 41.8% |

Why match rates matter: A 73% match rate (HubSpot) indicates formalized B2B companies with established LinkedIn presence—businesses that care about professional visibility. A 42% match rate (Klaviyo) suggests DTC brands and e-commerce operators who often don't maintain LinkedIn company pages. The match rate itself is a signal about user sophistication.

MailChimp: The SMB Generalist (301K Domains Analyzed)

The Profile: MailChimp remains the default choice for small businesses just getting started with email marketing.

Attribute | MailChimp User Profile |

|---|---|

Dominant Size | 1-10 employees (71%) |

89% have | 50 or fewer employees |

Top Industries | Retail (6%), Non-profits (10.5%), Wellness (2.2%) |

Geographic Center | US (34%), UK (12%), Canada (6%) |

Median Founded | 2013 |

Company Type | 32% Privately Held, 10.5% Non-profit |

Key Insight: MailChimp's 10.5% non-profit concentration is 5-13x higher than any competitor. It's become the de facto email platform for the third sector—churches, charities, community organizations. This explains Intuit's acquisition logic: MailChimp feeds the small business ecosystem that eventually needs QuickBooks.

Top Cities: London (3.2%), New York (1.2%), Los Angeles (0.8%), Toronto (0.7%), Paris (0.7%)

Klaviyo: The E-commerce Specialist (159K Domains Analyzed)

The Profile: Klaviyo has captured the direct-to-consumer market with surgical precision.

Attribute | Klaviyo User Profile |

|---|---|

Dominant Size | 1-10 employees (69%) |

Top Industries | Retail (13%), Fashion/Apparel (9.1%), Wellness (3.7%) |

Geographic Center | US (44%), UK (11%), Australia (8.8%) |

Median Founded | 2017 (youngest user base) |

Company Type | 48% Privately Held, only 0.8% Non-profit |

Key Insight: Klaviyo's 22% retail + fashion concentration is 4x higher than MailChimp's. These aren't just e-commerce companies—they're the DTC brands that emerged from the Shopify boom: skincare, supplements, athleisure, home goods. The 2017 median founding year confirms this is the platform of choice for pandemic-era DTC startups.

Australia over-indexes significantly (8.8% vs 4.4% for MailChimp)—reflecting the strong Shopify/DTC ecosystem in Sydney and Melbourne.

The DTC Vertical Stack:

Personal Care Manufacturing: 2.8%

Luxury Goods & Jewelry: 2.3%

Food & Beverage Manufacturing: 1.7%

Sporting Goods: 1.6%

HubSpot: The B2B Growth Engine (137K Domains Analyzed)

The Profile: HubSpot has successfully moved upmarket while maintaining its growth-company DNA.

Attribute | HubSpot User Profile |

|---|---|

Dominant Size | 1-10 employees (52%), but 23% are 11-50 |

51+ employees | 19% (3x higher than competitors) |

Top Industries | Software (8.1%), IT Services (6.3%), Agencies (5.4%) |

Geographic Center | US (39%), UK (10%), Germany (6.4%) |

Median Founded | 2015 |

Company Type | 59% Privately Held, 8% Public Companies |

Key Insight: HubSpot's 20%+ tech/software concentration makes it the platform of B2B SaaS. The 73% LinkedIn match rate—highest of any platform—confirms these are formalized businesses with sales teams, marketing departments, and professional operations.

The Enterprise Signal: HubSpot has 3x the mid-market presence (51-200 employees) of any competitor. Its tiered pricing and CRM integration attract companies that have outgrown simple email tools but aren't ready for Salesforce complexity.

City Profile: San Francisco (1.1%) and Boston (0.5%) rank unusually high—these are the B2B tech hubs where HubSpot's inbound methodology originated.

HighLevel: The Agency Ecosystem (83K Domains Analyzed)

The Profile: HighLevel has created something entirely new—a platform where agencies ARE the distribution channel.

Attribute | HighLevel User Profile |

|---|---|

Dominant Size | 1-10 employees (78%—highest of any platform) |

Top Industries | Marketing Agencies (17%), Wellness (5.2%), Construction (4%) |

Geographic Center | US (61%—highest concentration) |

Median Founded | 2018 (newest businesses) |

Company Type | 22% Self-Owned/Self-Employed (highest) |

Key Insight: The 17% marketing agency concentration tells the whole story. HighLevel isn't competing with MailChimp for end users—it's competing with white-label solutions for agencies. Those agencies then deploy it to thousands of local service businesses: dentists, roofers, gyms, real estate agents, chiropractors.

The Sun Belt Pattern: HighLevel's top US cities read like a map of America's fastest-growing metros:

Miami (0.86%)

Houston (0.83%)

San Diego (0.65%)

Dallas (0.61%)

Las Vegas (0.56%)

Tampa (0.51%)

Phoenix (0.46%)

These aren't tech hubs—they're local service business hubs where construction, real estate, and medical practices are booming.

The Solopreneur Signal: HighLevel's 22% self-owned/self-employed rate (vs 14% for others) reflects its target market: individual agency owners and local business operators who need all-in-one solutions.

ActiveCampaign: The Course Creator's Choice (63K Domains Analyzed)

The Profile: ActiveCampaign has carved out a unique niche as the platform for educators, coaches, and info-product creators.

Attribute | ActiveCampaign User Profile |

|---|---|

Dominant Size | 1-10 employees (64%), 11-50 (16%) |

Top Industries | Training & Coaching (5.6%), Advertising (5.4%), E-Learning (1.4%) |

Geographic Center | US (28%), Netherlands (11%), France (12%) |

Median Founded | 2014 |

Company Type | 42% Privately Held, 2.7% Educational Institutions |

Key Insight: ActiveCampaign's 5.6% professional training/coaching concentration is 2-3x higher than any competitor. Combined with 1.4% e-learning and 1% higher education, this is clearly the platform of choice for the knowledge economy: course creators, membership site operators, coaching businesses.

The European Anomaly: ActiveCampaign has the most geographically diverse user base of any platform. The 11% Netherlands and 12% France concentrations are extraordinary—this is where European coaching and online education markets have standardized on ActiveCampaign's automation workflows.

Top Cities: Amsterdam (0.88%) and Copenhagen (0.39%) appear prominently—both are hubs for the European coaching and personal development industry.

Brevo (Sendinblue): Europe's Default (72K Domains Analyzed)

The Profile: Brevo has become the GDPR-native alternative for European businesses who want to keep data local.

Attribute | Brevo User Profile |

|---|---|

Dominant Size | 1-10 employees (61%), but 17% at 11-50 |

Top Industries | Retail (4.4%), IT Services (4%), Software (3.7%) |

Geographic Center | France (22%), US (15%), Germany (8.3%) |

Median Founded | 2014 |

Company Type | 40% Privately Held, 6.3% Non-profit, 0.7% Government |

Key Insight: Brevo's 22% France concentration and Paris headquarters make it the obvious choice for French businesses. But the real signal is the 0.7% government agency usage—highest of any platform. European public sector organizations choose Brevo for data sovereignty.

The Tourism Connection: Brevo shows notably strong presence in travel (1.2%) and hospitality (1.3%)—the European tourism industry has standardized on local email providers.

City Concentration: Paris alone accounts for 4.4% of all Brevo users—the highest single-city concentration of any platform we track.

Cross-Platform Insights: What the Data Reveals

1. Company Size Reveals Platform Positioning

Platform | Micro (1-10) | Small (11-50) | Mid (51-200) | Enterprise (201+) |

|---|---|---|---|---|

HighLevel | 78% | 11% | 2% | 0.5% |

MailChimp | 71% | 13% | 4% | 2% |

Klaviyo | 69% | 15% | 5% | 2% |

ActiveCampaign | 64% | 16% | 7% | 3% |

Brevo | 61% | 17% | 7% | 4% |

HubSpot | 52% | 23% | 13% | 6% |

HubSpot's mid-market dominance is clear. HighLevel's micro-business focus reflects its agency distribution model.

2. Industry Concentration Defines Use Case

Use Case | Platform | Key Industry Concentration |

|---|---|---|

E-commerce/DTC | Klaviyo | 22% Retail + Fashion |

B2B SaaS | HubSpot | 20% Software + IT |

Local Services | HighLevel | 17% Agencies + 12% Local Services |

Course Creators | ActiveCampaign | 7% Training + E-Learning |

Non-profits | MailChimp | 10.5% Non-profit |

European SMB | Brevo | 22% France, 0.7% Government |

3. Geographic Patterns Reveal Market Strategy

Platform | US Concentration | Europe Concentration | Key Non-US Market |

|---|---|---|---|

HighLevel | 61% | 8% | Canada (6%) |

Klaviyo | 44% | 18% | Australia (8.8%) |

HubSpot | 39% | 23% | Germany (6.4%) |

MailChimp | 34% | 30% | UK (12%) |

ActiveCampaign | 28% | 35% | Netherlands (11%) |

Brevo | 15% | 52% | France (22%) |

4. Company Age Signals Market Maturity

Platform | Median Founded | Interpretation |

|---|---|---|

HighLevel | 2018 | New agencies, new local businesses |

Klaviyo | 2017 | DTC boom generation |

HubSpot | 2015 | Growth-stage companies |

ActiveCampaign | 2014 | Established knowledge businesses |

Brevo | 2014 | Mature European SMBs |

MailChimp | 2013 | Legacy small businesses |

Part 6: Industry-Specific Patterns and Case Studies

Healthcare: The Patient Engagement Revolution

Healthcare domains show distinctive patterns in our crawls. The sector has moved beyond simple appointment reminders to comprehensive "Patient Journey Management," driven by the need to improve outcomes while navigating strict regulatory frameworks.

Case Study: Oscar Health – Personalized Member Outreach

Oscar Health adopted a "hackathon" culture toward Generative AI, developing 47 insurance-specific Large Language Models. According to Oscar's AI strategy documentation and Digital Insurer analysis, they utilized their proprietary "Campaign Builder" platform to run rigorous experiments on messaging effectiveness.

The AI models analyzed member health profiles to generate highly specific outreach campaigns, introducing dynamic "action items" on mobile app home screens. This data-driven approach led to significant improvements in Net Promoter Score (NPS) and Medical Loss Ratio (MLR)—proving that automation drives both satisfaction and profitability (Oscar Tech Blog).

Case Study: Doctolib (France) – Scaling Access to Care

Doctolib, managing 500 million appointments annually, leveraged Microsoft Azure AI and massive SMS automation infrastructure (25 million messages/month). According to smsmode case study and Microsoft's AI success stories, their AI Consultation Assistant transcribes patient visits in real-time and generates structured medical summaries.

Results: Clinicians reported 2x increase in face-to-face patient time, while automated SMS drastically reduced no-show rates.

E-commerce: Agentic Commerce

Case Study: Tatcha – The "Fukubukuro" Strategy

Tatcha utilized Klaviyo's sophisticated segmentation for their annual New Year promotion. According to Klaviyo's case study, they moved from batch-and-blast tactics to "Category Affinity" targeting—identifying less-engaged subscribers who had previously purchased featured product categories.

Using "Smart Sending" features for frequency management, the strategy delivered 20% year-over-year revenue growth for the promotion, demonstrating that precise segmentation allows brands to safely market to "dormant" users when content is highly relevant.

Case Study: Sesame Care – Closing the Loop

Sesame Care implemented Braze for engagement and Segment (CDP) for data unification to convert visitors who didn't transact on first visit. According to Braze's case study, they created a "nurture layer" tracking specific behavioral events to guide users back to booking.

Result: The new stack successfully converted "window shoppers" into patients, creating sustainable revenue streams outside expensive paid search acquisition.

B2B/SaaS: Account-Based Orchestration

B2B domains reveal evolution from lead generation (volume) to account-based orchestration (precision). According to The Smarketers' 2026 trends analysis, AI tools now identify entire "buying committees" within target accounts, serving distinct content streams to each role.

Platforms like Monday.com CRM enable shared dashboards ensuring marketing "warm-up" activities and sales outreach are perfectly synchronized.

Part 7: The Enterprise Battle—HubSpot vs. Salesforce

The rivalry between HubSpot and Salesforce has intensified, reshaping the mid-market and enterprise segments.

HubSpot's Up-Market March

HubSpot has successfully shed its "SMB-only" reputation. With the launch of Breeze AI and advanced Workspaces, it now offers governance and power required by large organizations while retaining signature usability (HubSpot Spring 2025 Spotlight).

According to Cometly's platform comparison, HubSpot has become a prime destination for companies migrating away from complex legacy systems.

Salesforce's Agentic Defense

Salesforce retains dominance in complex, multinational deployments through Agentforce—allowing enterprises to deploy autonomous service and sales agents within the Salesforce ecosystem. According to SalesHive's comparison, Salesforce's data gravity remains unmatched for organizations requiring extreme customization.

However, Pixel Consulting's analysis notes that for organizations not requiring such complexity, Salesforce increasingly appears to have high "Total Cost of Ownership" compared to nimbler rivals.

Part 8: Migration and Modernization Patterns

The "Marketo to HubSpot" Wave

Market intelligence indicates significant migration from Adobe Marketo to HubSpot's Marketing Hub Enterprise. According to Aptitude 8:

Operational Drag: Legacy platforms require specialized technical staff for basic campaigns; HubSpot's "product-first" design lets marketers execute without engineering support

Total Cost of Ownership: Marketo pricing can range from $960 to over $7,000/month with add-ons; HubSpot offers transparent pricing and lower implementation costs (Envy Blog Migration Guide)

Feature Parity: With "Breeze" AI agents and enterprise governance tools, HubSpot has closed the feature gap

Unifying Data on Salesforce Data Cloud

For global enterprises where Salesforce is the system of record, migration is internal—moving disparate data sources into Salesforce Data Cloud. According to 360 Degree Cloud, this enables "Identity Resolution" at scale, creating the foundation for Agentforce.

Scandiweb's case study documents how a luxury fashion house unified customer profiles across boutiques and online stores, enabling stylists to provide recommendations based on clients' online browsing history.

Part 9: ROI, Budgeting, and the New Metrics

Budget Trends: Efficiency Over Volume

Marketing budgets in 2026 reflect a "consolidate and conquer" strategy. According to Neil Patel's budget analysis, CFOs are scrutinizing tech stacks, demanding elimination of redundant tools. "Spray and pray" tactics are being defunded in favor of channels with defensible, attributable ROI.

As AI agents automate content distribution, the marginal cost of sending messages drops to near zero. Consequently, value shifts to creating high-quality, distinctive content. Budgets are reallocating from ad spend to creative production (Digital Marketing Institute Trends).

The Return on Automation

Industry benchmarks suggest compelling economics:

$5.44 return for every dollar invested in marketing automation (Cropink Statistics)

2,000% ROI achieved by businesses implementing behavioral triggers (ActiveCampaign via Enricher.io)

30% of revenue generated through automated flows for optimized e-commerce brands

New Success Metrics

The KPIs of 2026 have evolved to measure autonomy effectiveness:

Return on Automation (ROA): Financial yield per automation dollar

Velocity Metrics: Lead velocity and time-to-close rather than lead volume

Agent Performance: Human intervention rate and tasks-per-agent measuring operational leverage

Part 10: Future Outlook—Invisible Marketing (2027-2030)

As we look beyond 2026, the trajectory points toward Invisible Marketing—where technology disappears into seamless customer experience.

According to KEO Marketing's AI guide and Brands at Play's trend analysis:

Autonomous Budget Allocation: By 2028, AI agents will likely control majority of media buying—dynamically shifting budgets between channels based on real-time ROAS without requiring human sign-off for adjustments.

The End of the Dashboard: The "Conversational UI" will replace complex analytics dashboards. Marketers will simply ask systems for insights, receiving instant natural-language reports.

Governance as Primary Role: As agents take over execution, human marketers will shift to setting ethical guardrails, brand voice guidelines, and strategic objectives within which AI operates (Improvado AI Guide).

Part 11: Key Strategic Insights

After analyzing 30 million domains and synthesizing industry research, several strategic insights emerge:

1. Distribution Model Innovation Beats Feature Competition

HighLevel didn't win on features—it won by creating a distribution model reaching businesses traditional software sales cannot. The lesson: how you deliver software matters as much as what it does.

2. Ecosystem Alignment Trumps Everything

Klaviyo's dominance in e-commerce, Brevo's strength in Europe, HubSpot's traction among scaling startups—each platform's success correlates with deep ecosystem integration, not feature comparison charts.

3. Specialization Outperforms Generalization

The fastest-growing platforms in our data (Klaviyo, HighLevel) have the clearest positioning. MailChimp's attempt to become everything to everyone hasn't prevented growth, but it's grown slower than focused competitors.

4. The Agency Channel Is Undervalued

HighLevel's success demonstrates that agencies function as highly effective distribution channels. For the SMB market, "managed service" may prove more sustainable than "self-service."

5. AI Readiness Requires Data Unification

Organizations successfully deploying agent-based automation have completed data unification projects. Fragmented stacks can't feed AI systems effectively—expect continued migration toward unified platforms.

6. Brand Is the Ultimate Ranking Factor

According to Insider One's best practices guide, successful automation builds brand value that algorithms must recognize. Every click is a vote; user experience has become direct ranking input.

Methodology

This report draws on TechnologyChecker.io's proprietary technology detection infrastructure combined with industry research:

Primary Data Source: Weekly crawls across 50+ million domains, detecting technology installations through HTTP headers, JavaScript libraries, DNS records, and HTML patterns.

Platforms Analyzed:

Platform | Detection Method |

|---|---|

MailChimp | JavaScript embed, form patterns |

Klaviyo | JavaScript SDK, API calls |

HubSpot | Tracking code, forms |

HighLevel | Tracking scripts, widgets |

Brevo | JavaScript tracking |

ActiveCampaign | Form embeds, tracking |

Detection Accuracy: 95% accuracy across 20,000+ tracked technologies, validated against known implementations.

Secondary Sources: Industry reports from Fortune Business Insights, Grand View Research, Mordor Intelligence, BuiltWith Trends, and platform-specific case studies.

Historical Data: 20-year historical trend data enables longitudinal analysis of technology adoption patterns.

Limitations: Data reflects detectable web installations only. Mobile apps, server-side implementations, and custom domains may reduce detection accuracy for some deployments.

Conclusion: What This Means for Your Strategy

The marketing automation landscape has transformed from MailChimp's near-monopoly in 2015 to a diverse, competitive ecosystem in 2026. The winners share common characteristics: clear positioning, ecosystem alignment, innovative distribution, and AI-ready architecture.

For marketers evaluating platforms, the data suggests focusing less on feature comparisons and more on:

Ecosystem fit: Does the platform integrate deeply with your core systems?

Distribution alignment: Does the vendor's sales model match your buying preferences?

Data architecture: Can the platform support agent-based automation as it matures?

Specialization: Does the platform focus on your specific use case or try to serve everyone?

The platforms dominating our detection data aren't necessarily those with the longest feature lists—they're the ones that have made intentional choices about who they serve and how they deliver value.

References

Fortune Business Insights - Marketing Automation Software Market: https://www.fortunebusinessinsights.com/marketing-automation-software-market-108852

Grand View Research - Marketing Automation Market Analysis: https://www.grandviewresearch.com/industry-analysis/marketing-automation-software-market

Mordor Intelligence - Marketing Automation Software Market: https://www.mordorintelligence.com/industry-reports/global-marketing-automation-software-market-industry

The Business Research Company - Marketing Automation Report: https://www.thebusinessresearchcompany.com/report/marketing-automation-global-market-report

Cropink - Marketing Automation Statistics: https://cropink.com/marketing-automation-statistics

Birdeye - Enterprise Marketing Automation Tools: https://birdeye.com/blog/marketing-automation-tools/

This analysis is powered by TechnologyChecker.io's technology detection platform, which provides real-time technology profiles, verified contacts, and 20-year historical data across 50+ million domains. For custom technographic analysis or API access, visit technologychecker.io.

About the Author

Mehmet Suleyman is the CEO & Co-founder of TechnologyChecker.io, where he drives innovation in technographic intelligence. With expertise in web crawling, data analytics, and AI-driven insights, Mehmet leads a platform delivering 95% detection accuracy across 20,000+ technologies. He holds an M.Sc. in Data Science and Artificial Intelligence from Middle East Technical University and certifications including AWS Solutions Architect and Google Cloud Professional Data Engineer.

Connect with Mehmet on LinkedIn | Follow TechnologyChecker.io for weekly technology adoption insights.